Joe’s Pharmacy fills a large number of scripts every month. And, the business was profitable last year.

But when it’s time to pay the bills, Joe’s doesn’t have enough money in the bank to cover its expenses. And, the pharmacy’s lack of cash makes it impossible to invest in any new revenue-generating opportunities.

Despite its profitability, Joe’s ends up closing its doors.

If your business can’t convert sales to cash in the bank when you need it, you could be in trouble.

Don’t let your independent community pharmacy suffer because you don’t understand the importance of cash flow. Here’s a crash course on cash flow.

Cash flow vs. profit

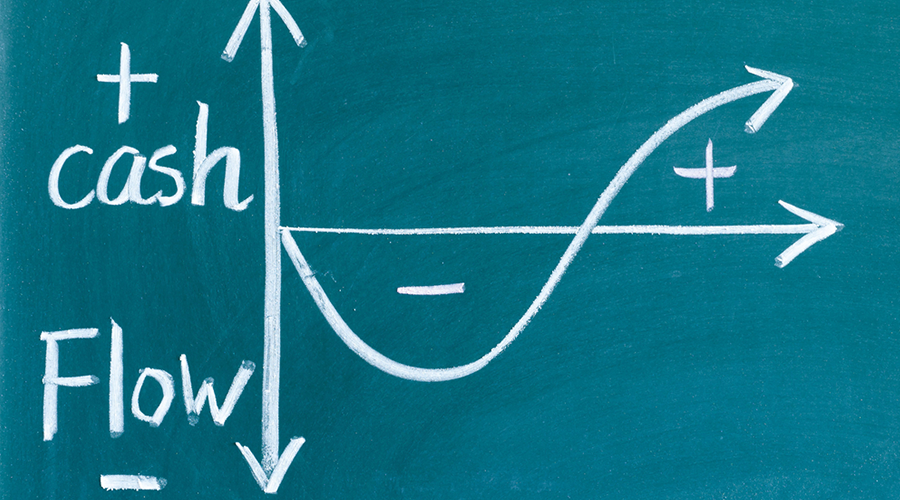

Your cash flow is the amount of money flowing in and out of your business.

Cash flow is what finances your day-to-day operations. In other words, it pays the bills.

Profit is your revenue minus your expenses. And contrary to popular belief, profit is not the only measure of your business’s success.

Your pharmacy can be profitable without having enough cash to pay your expenses at a given time.

For example, when a patient pays for a prescription, many factors affect when you’ll see the money from that prescription in your account. You have to consider how long it could take for third party payers to reimburse your pharmacy.

Even if you plan to eventually profit from the prescription sale, you need to have enough cash in the bank to pay your bills in the meantime.

Proven Strategies Guaranteed to Boost Pharmacy Cash Flow (+Advanced Formulas)

Proven Strategies Guaranteed to Boost Pharmacy Cash Flow (+Advanced Formulas)

These little-known strategies and advanced formulas will free up cash and grow your pharmacy. Read the article.

Why cash flow is important

You need money coming in before you can put money out.

Positive cash flow means you have more liquid money on hand at the end of a given time period compared to what was available when that time period began. Your cash inflow needs to be greater than your cash outflow.

Positive cash flow allows you to:

- Pay the bills. You need cash in the bank to pay your employees, wholesalers, rent and utilities, among other expenses. If you don’t have good cash flow, your business will likely suffer.

- Invest in new opportunities. As an independent community pharmacy, investing in new opportunities is necessary to stay relevant and competitive. If you have positive cash flow, you’ll have the money on hand to start a new service, such as a diabetes management program.

- Be prepared. You can’t predict the future, but you can prepare for it. When you maintain good cash flow, you’ll give your business a better chance to survive an emergency or unpredictable event. For example, say your pharmacy encounters a plumbing problem. If you have enough cash in the bank, you can pay to fix the problem without stressing about where the money will come from.

When you have negative cash flow

But your cash flow can also be negative. In fact, many small businesses fail due to a negative cash flow problem.

If you’re spending more money than you have coming in, you have a negative cash flow. This is when most businesses begin to suffer, as they struggle to pay their bills, are unable to invest in new opportunities and can’t cover their expenses in the case of an emergency.

Fortunately, you can manage—and even improve—your cash flow. Stay tuned for our next article in this crash course on cash flow to learn more.

Want more business tips and advice? Sign up for our e-newsletter.

Proven Strategies Guaranteed to Boost Pharmacy Cash Flow (+Advanced Formulas)

Proven Strategies Guaranteed to Boost Pharmacy Cash Flow (+Advanced Formulas)