By now, everyone in the industry understands the woes of independent pharmacy: below-cost reimbursements, sky-high DIR fees, PBM steering, lack of provider status.

Every analysis of the current state of the industry points to these obvious villains. As the NCPA Digest explains, “Falling gross profit is mostly the result of below-cost reimbursement in public and private third-party contracts combined with unpredictable pharmacy direct and indirect remuneration fees in Medicare Part D.”

But there’s one statistic in the data that doesn’t make headlines. A statistic that tips the profit pendulum. Most importantly, a statistic that pharmacies can actually control.

The crucial pharmacy statistic no one is talking about

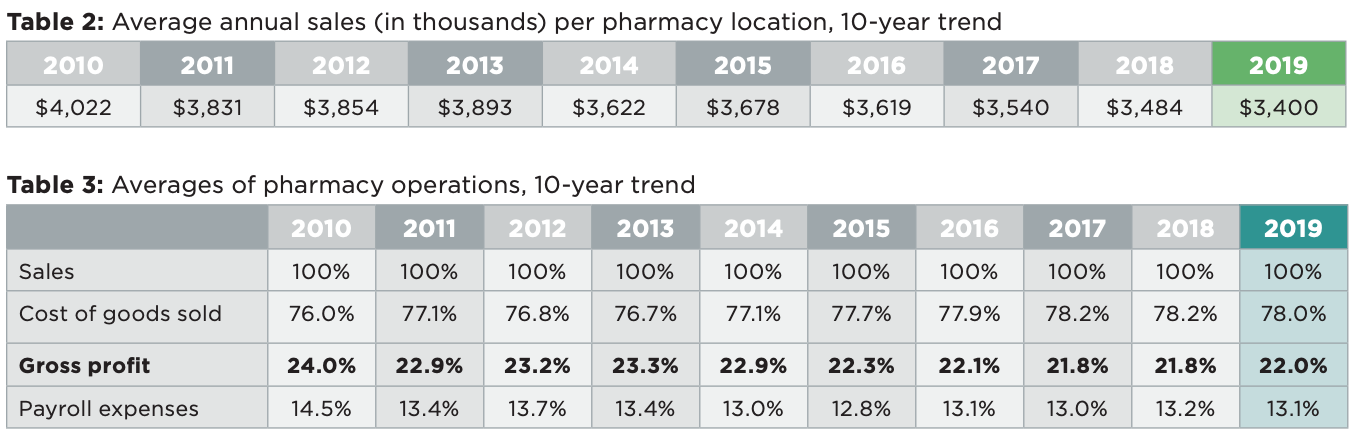

Take a look below at the financial data from the 2020 NCPA Digest.

The first thing to notice is that revenue has dropped by $600,000 since 2010. That’s a startling number.

Because of that, it may not be surprising that gross profit margin fell by 2 percent over that same period.

But should that be expected?

A loss in sales means a loss in profit in terms of dollars, but it does not necessarily mean a loss in margin. Margin is simply the ratio of sales to costs. If you are selling fewer products in total, you should also be spending less in total (because you’re buying fewer products at the same rate). In that case, your loss in sales wouldn’t affect your margin.

The problem is that pharmacies are getting paid less for each product but not spending less on those products. So, the cost of goods sold goes up 2 percent, sending gross profit margin down 2 percent.

That means the current payment model is not the sole reason profit margins are declining.

The other reason is the pharmacy’s cost of goods sold.

There are only two factors in the equation for gross margin: sales and costs. If you can’t change your sales (how much you get paid for a prescription), you need to change your costs.

In one sense, this is good news. Unlike the loss in sales due to third-party scheming, which is totally outside of your pharmacy’s control, the increased cost of goods can be mitigated. You can’t change your PBM reimbursements or DIR fees, but you can implement strategies and partnerships to reduce your cost of goods sold. And what’s striking is that pharmacies can completely reverse that 2 percent loss in margin by focusing on their costs of goods alone (more details on that later).

Let’s look at how much of the $600,000 pharmacies can get back by focusing on improving their cost of goods sold. On average, a pharmacy makes $3,400,000, making cost of goods $2,651,758. That’s with costs of goods sold at 78%. Here’s how much money a pharmacy could save by reducing their costs of goods by 1% to 6%:

77%

Total cost: $2,618,000

Total reduction: $33,758

76%

Total cost: $2,584,000

Total reduction: $67,758

75%

Total cost: $2,550,000

Total reduction: $101,758

74%

Total cost: $2,516,000

Total reduction:$135,758

73%

Total cost: $2,482,000

Total reduction: $169,758

72%

Total cost: $2,448,000

Total reduction: $203,758

Improving your gross margin by just 3% by reducing your cost of goods can save you $101,758 per year alone. Make that 6% and you save $203,758 per year. And all of that is pure profit.

How to reduce your cost of goods sold

It’s one thing to show how much you can save by reducing your cost of goods sold. The real question is how do you do that? After all, wholesalers set the prices. And most independent community pharmacies don’t have the leverage to negotiate with them. It’s take it or leave it. How much control over that do pharmacies really have?

A lot more than you’d think.

There are three strategies for reducing your cost of goods:

- Gain negotiation power by increasing your purchase volume

- Max out the incentives in your primary wholesaler contract to maximize rebates

- Seek out the best prices on high-cost items from secondary wholesalers

Let’s take each of these one at a time.

Gain negotiation leverage by increasing purchase volume

It costs wholesalers a lot to get products to your pharmacy. The staff, technology, and time required for logistics is considerable. That means they have to make a considerable amount of money from a pharmacy to make it worth their time and effort. If you are a single community pharmacy, they don’t have much incentive to give you a favorable contract because the profit they make from you won’t be worth it. This is why major chains getting much better pricing. Their volume is through the roof. The distribution costs for servicing an independent are about the same, yet the revenue is paltry in comparison.

And independent pharmacies have little control over volume. Even if you double your script count this year, you’ll still offer too little to gain leverage. This is why pharmacies get involved in buying groups, or group purchasing organizations (GPO). To make it more worth wholesalers’ while, buying groups pool multiple pharmacies’ book of business into one bucket, getting the total volume closer to chain pharmacies.

On Drug Channels, Adam Fein wrote, “Pharmacy owners have responded to their own profit pressures partly by collaborating with peers via Group Purchasing Organizations (GPOs). These pharmacy buying groups have altered and accelerated wholesaler competition for the business of independent pharmacies … As the GPOs have grown, wholesalers have had to compete more aggressively to win and retain the business of the groups and their members. When a buying group switches its primary wholesaler, the non-selected wholesalers will work hard to retain as much business as possible.”

This is really the only way to get better pricing from a primary wholesaler. And it really does work. Pharmacies working on their own most certainly are paying more for their cost of goods just based on the basic economics of these relationships.

In general, buying groups will improve your cost of goods, regardless of their specific benefits. But not all buying groups provide the same amount of leverage due to one overlooked factor. A large portion of buying groups, including some of the most popular ones, are committed to partnering with a single wholesaler. Although the buying group will still improve an independent pharmacy’s cost of goods, the established relationship with that single wholesaler makes the buying group less effective. The reason is that it removes the element of competition, which is essential to driving down prices. The wholesaler doesn’t have to compete with other wholesalers to win your business, so they have less incentive to give you the best deal possible. The best option is to join buying group that solicits bids from several national wholesalers, motivating them to compete for your business and ensuring you get the best deal in the market.

Max out incentives in the primary wholesaler contract

For pharmacies, inventory pricing is complex. The net cost of goods is affected by many different factors within your wholesaler contract. It’s much more than getting a list price and paying for it.

Most of the factors are interdependent — changing one affects another — and most of them depend on the pharmacy’s buying behavior.

These are some those factors that could influence a pharmacy’s cost of inventory:

- Generic rebate based on ratio of generic purchases

- Generic rebate based on generic dollar volume

- Brand discount

- Brand discount based on volume

- Additional performance/program related incentives

- Current pricing and availability

- Specified contract items

- Designated specialty items

- Pay terms

- Total dollar volume commitments

- Percentage of volume commitments

To truly achieve the lowest cost of goods, you need to fully understand the details of every one of these factors. It’s a very complex set of mathematical problems that must be recalculated every day and take into consideration all purchases made since the beginning of a month, as well as all purchases that will be made throughout the remainder of a month. And these calculations need to account for each of the factors listed above.

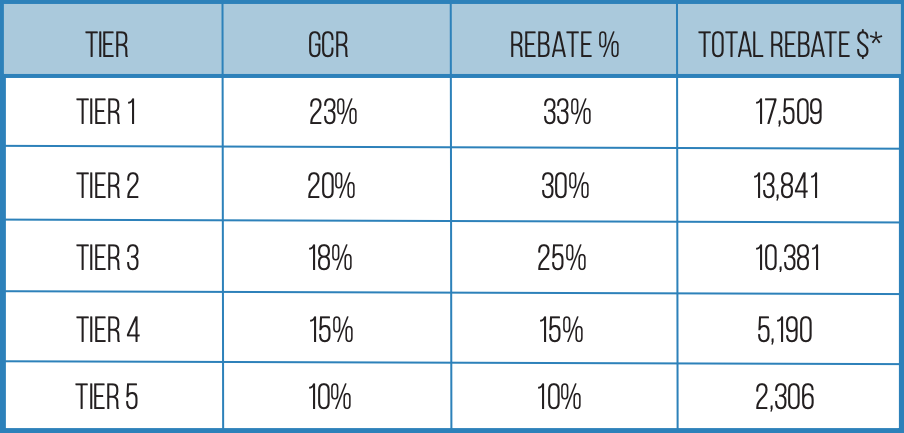

Although wholesalers also offer rebates based on generic dollar volume, brand volume, and more, the most common and most significant incentive is the generic compliance ratio, usually measured as total generic purchases divided by total Rx purchases. The rebates are structured to have multiple tiers, so the more generics you buy, the higher your rebate.

Maxing out your generic compliance rebate means a lower cost of goods and more profit to put back in your pocket — potentially a lot more. Take a look at the sample rebate matrix below for an average independent pharmacy, which illustrates the substantial difference in monthly savings a pharmacy can earn or lose based on its generic compliance.

Notice how a seemingly innocuous purchase outside the primary contract may take you from 18% to 17.99%, which would drop you a tier and lose you more than $4,000 for that month. Also take note of the difference between meeting the top compliance goal and meeting none of the goals: $17,509 for a single month, or $210,108 per year.

Seek out the best prices on high-cost items from secondary wholesalers

Getting the most out of your primary wholesaler contract is the best way to manage your cost of goods, but there are times when your primary wholesaler might not have the best price or might be out of the NDC you need.

When these situations inevitably arise, you need to have a reliable secondary supplier to help keep your cost of goods manageable.

There are a lot of secondaries to choose from, but they aren’t all created equal. Secondaries offering dirt-cheap prices could seem like they have the best deal, but those deals often come with hidden costs. Even if they have a state license, they could be providing counterfeit or illegitimate drugs.

It’s also important to consider the time cost of trying to find the best prices by searching with several secondaries. Instead of wasting time and running the risk of receiving fraudulent products, independent pharmacies should settle on a reliable secondary with consistently low prices.

A good secondary supplier will be certified by the National Association of Boards of Pharmacy (NABP) and be a member of the Healthcare Distribution Alliance (NABP). These credentials are a signal that the wholesaler has passed through a stringent review process and the drugs they sell come from a secure supply chain.

Two solutions that give you everything

ProfitGuard®, a unique buying group from PBA Health, ensures pharmacies get the best costs of goods possible. It guarantees a better contract than you have now (an actual guarantee), and it offers a proprietary analytic tool to help pharmacies maximize wholesaler rebates and savings on their inventory every day. ProfitGuard members report 2 to 6 percent increase to their gross profit margin on average.

“It’s the industry game changer for the independent pharmacy owner or operator,” says Huy Duong, owner of Dale’s Pharmacy in Colorado. “There’s nothing out there like it on the market.”

BuyLine®, an NABP-accredited secondary supplier, offers a full line of brands, generics, OTCs, and controls at the lowest prices in the secondary market. In addition to having low list prices, BuyLine also rewards purchases with cash rebates and significant discounts on brands. Earn up to an additional 10% cash rebate on generics and up to WAC -4% on brand.

A Member-Owned Company Serving Independent Pharmacies

PBA Health is dedicated to helping independent pharmacies reach their full potential on the buy-side of their business. Founded and owned by pharmacists, PBA Health serves independent pharmacies with group purchasing services, wholesaler contract negotiations, proprietary purchasing tools, and more.

An HDA member, PBA Health operates its own NABP-accredited secondary wholesaler with more than 6,000 SKUs, including brands, generics, narcotics CII-CV, cold-storage products, and over-the-counter (OTC) products — offering the lowest prices in the secondary market.