Of the many ways retail pharmacies differ from other retailers, managing the cost of inventory might be the most significant. For traditional retailers, inventory costs are simple. They pay a flat price for their product, which they know upfront, and nothing they do after that will alter the cost. Not so for pharmacy inventory, of which the sticker price is only a small piece of a large pricing puzzle.

“There’s an array of complex, interconnected factors that determine a pharmacy’s ultimate cost of goods, including their buying behavior,” said Clark Balcom, senior vice president and COO of PBA Health, a company that helps independent pharmacies improve the buy-side of their business with purchasing optimization technology, group purchasing services, expert contract negotiations, and VAWD-accredited distribution services.

A pharmacy’s cost of goods is primarily tied to a variety of complicated terms and incentives found within their wholesaler contract. For example, a pharmacy wholesaler contract may include a brand discount, brand rebate, and generic rebate, each with its own tiered incentive structure based on a certain volume of purchases relative to certain commitments in certain categories and with certain formularies. Sound like a mouthful? That’s because it is. And any given purchase affects your compliance to those incentives, meaning any given purchase could reduce your rebates if you buy incorrectly.

“You have to be able to track and predict how every purchase will affect your incentives in addition to ever-changing prices and availability,” Balcom said. “And to even begin to do that you have to have a complete grasp of all your contract terms and arrangements in the first place.”

Without understanding how every single purchase at any moment affects your overall arrangement now and at the end of the month, you can’t know how much the true cost of any item is.

That cost complexity means that getting the lowest cost of inventory takes much more commitment and resources than most independent pharmacies are able to give to their purchasing. “As managing the financial and operational costs of inventory has become more complex, the most costly mistake we see pharmacies make is failing to have a comprehensive purchasing strategy that is supported by formalized management systems and procedures,” Balcom said. “It’s just an inexcusable flaw existent in too many pharmacies today.”

It’s Complicated: Factors That Determine Your Final Cost of Inventory

A host of factors influence a pharmacy’s total cost of inventory beyond the sticker price. Most of the factors are interdependent—changing one affects another. All of them depend on the pharmacy’s buying behavior. To truly achieve the lowest cost of inventory, you need to continuously monitor and optimize every factor simultaneously every month. Below are some those factors that could influence a pharmacy’s cost of inventory.

Generic rebate based on Generic Compliance Ratio

Rebates for reaching a specified ratio of generic purchase volume relative to overall Rx volume

Generic rebate based on Generic dollar volume

Rebates for reaching a specified dollar volume of generic purchases

Brand discount

Upfront, or off-invoice, savings the pharmacy receives on every brand purchase

Brand discount based on volume

Additional brand savings after reaching specified dollar volumes or other incentives

Additional performance/program related incentives

Rebates based on participation in certain programs or specified performance metrics

Current pricing and availability

Lowest sticker price across primary wholesaler and secondary suppliers

Specified contract items

Portfolio of generic contract items that are eligible for rebate

Designated specialty items

More expensive brand items that factor into incentive structures differently than traditional brand items

Pay terms

Additional discounts based on how quickly the pharmacy pays for the inventory

Total dollar volume commitments

Total dollar amount the pharmacy agreed to commit to purchase from wholesaler

Percentage of volume commitments

Percentage of purchases the pharmacy agreed to commit to purchase from wholesaler

Costly choices

Because every contract contains incentive structures, the amount you end up spending on inventory depends on repeated purchasing decisions. On any given day, those decisions may not seem consequential, but they could be catastrophic when compounded. “Habitually making suboptimal purchasing decisions is a pharmacy’s fastest path to business failure,” Balcom said.

Consequences are so steep because of the monumental cost of a pharmacy’s inventory, which makes up 80 percent of an average pharmacy’s total expenses. A compass skewed one degree won’t take you too far off track when you’re traveling one mile. But use that same compass to cross the Atlantic and you’ll end up in the wrong country. Likewise, each incorrect purchase nudges your pharmacy off the course of your incentives and eventually lands miles away from your maximum rebates.

Poor purchasing choices are perpetuated by failing to know exactly where you stand and exactly what effect every purchase has on your overall contract arrangement. Much of the time, purchases that appear smart end up smarting.

For example, take one of the most common purchasing strategies pharmacies use to try to reduce costs: chasing cheap deals from secondary suppliers. Say you find discounted amoxicillin from a secondary supplier for $100 in savings. Looking at the sticker price comparison alone, that’s a good move. But what you didn’t realize is that shifting that purchase away from your primary contract dropped you a tier on your generic rebate structure. Instead of getting 30 percent back this month, now you’ll be getting 25 percent. For the average pharmacy, that’s a potential loss of $3,000. And that’s only one of your incentives that has been skewed—your purchase decision may have also reduced other rebates available in your contract.

“If you only do item-by-item comparisons, then you’re likely going to force yourself to miss your incentives. You might save ten dollars only to give up fifteen. And that’s usually what pharmacies do,” Balcom said. “If you start spreading your purchases among several different suppliers, then you’ve probably hit the point where you can’t optimize because you’re spreading your volume in so many different directions that you can’t get the benefit of that volume. Or you’re spreading the best part of your volume, which is your generics, to where you can’t get your mix to be healthy anywhere.”

“Habitually making suboptimal purchasing decisions is a pharmacy’s fastest path to business failure.”

That was the case for Teresa Butler, owner of RxShoppe in Grove, Oklahoma. Her team habitually spread purchases across suppliers hunting for the best deal, a task that involved tracking down prices from up to six different suppliers. “We were simply trying to find the cheapest price out there,” she said. “This might even be for an item that was $3 in savings—it’s hard to change this habit in employees.”

In Balcom’s 20 years working behind the scenes on independent pharmacy wholesaler contracts, he’s seen this scenario everywhere—even from the smartest and most successful owners like Butler. “Without exception, we find losses in rebates and other incentives offsetting the savings these pharmacies intended,” he said. “Worse, frustration and complaints about the time and effort it takes to ultimately make wrong purchasing decisions is a real pain point. Unfortunately, we come across these scenarios every day.”

In other cases, pharmacies will be diligent in meeting their primary volume commitments needed to achieve incentive requirements, but then they end up overcommitting and missing out on thousands in sticker price savings. “Saving money is a good thing,” Balcom said. “There are times when purchasing from a secondary supplier is both necessary and beneficial. Finding the right balance that produces maximum benefits is key.”

These common purchasing woes are only some of what Balcom sees consistently in pharmacies. And the unfortunate truth is that no matter what they do, pharmacies can’t truly optimize their savings because they can’t really know if any purchase will ultimately save them or cost them, he said. “Pharmacies don’t know where the line is. Pharmacy cost of inventory is really a challenging game of effective portfolio management. It’s a very complex set of mathematical problems that must be recalculated every day and take into consideration all purchases made since the beginning of a month, as well as all purchases that’ll be made throughout the remainder of a month. And these calculations need to account for contract incentive structures, purchase volumes, product mix, multiple suppliers, availability of product, and daily price changes.”

The Most Important Factor Pharmacies Neglect

Although wholesalers also offer rebates based on generic dollar volume, brand volume, and more, the most common and most significant incentive is the generic compliance ratio, usually measured as total generic purchases divided by total Rx purchases. The rebates are structured to have multiple tiers, so the more generics you buy, the higher your rebate.

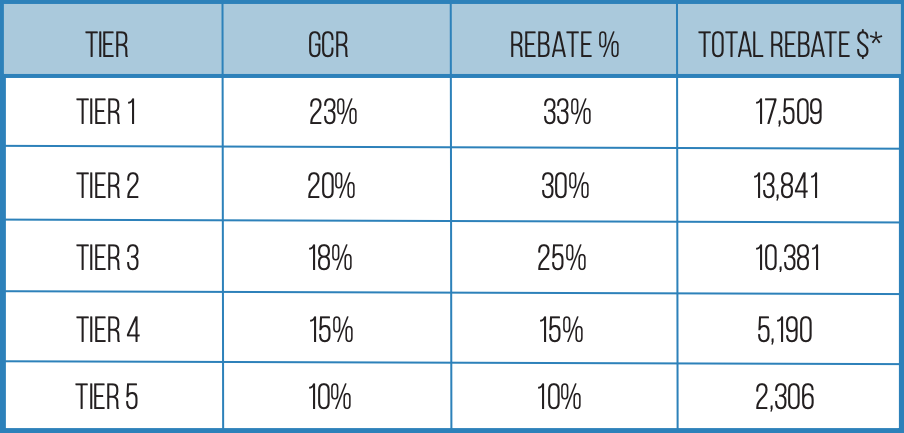

Maxing out your generic compliance rebate means a lower cost of goods and more profit to put back in your pocket — potentially a lot more. Take a look at the sample rebate matrix below for an average independent pharmacy, which illustrates the substantial difference in monthly savings a pharmacy can earn or lose based on its generic compliance.

Notice how a seemingly innocuous purchase outside the primary contract may take you from 18% to 17.99%, which would drop you a tier and lose you more than $4,000 for that month. Also take note of the difference between meeting the top compliance goal and meeting none of the goals: $17,509 for a single month, or $210,108 per year.

The total purchasing solution

So then, what can a pharmacy do? Even though a person can’t fully optimize purchasing, technology can. “Large chains like Walgreens have had extensive decision support systems in place for over two decades to help them make optimal daily purchasing decisions,” Balcom said. “Independent pharmacies should have the same advanced solutions and benefits. It’s time to modernize and employ technologies and tools to operate a lot more effectively.”

ProfitGuard Navigation, a purchasing optimization tool from PBA Health, can calculate how every purchase will affect your total cost of inventory. And it harnesses that precise, predictive data to maximize your savings. “It’s taken over twenty years and countless resources to build up the assets, processes, and systems that comprise a total management solution,” Balcom said. “There’s nobody else that provides pharmacies with an entire end-to-end solution that takes into consideration all possible economic factors associated with achieving maximum rebates and profitability.”

The Navigation tool takes all the pharmacy’s contract information and every purchase from the last 90 days and puts it into a sophisticated modeling system. The system takes everything into account: all contract incentives from your primary wholesaler and PBA Health, current prices, availability, volume commitments, personal preferences, etc. Using this information, it recursively simulates all possible variations in your product and supplier purchasing mix, ultimately landing on a targeted model to maximize your rebates and savings.

“We use predictive modeling to help pharmacies figure out the optimal purchases they should make with their primary wholesaler to meet their contractual commitments while earning the most dollars they can under their performance incentives.” Balcom said. “And many times, this leads to us helping pharmacies negotiate needed improvements to their wholesaler contracts such that the exchange of purchases for incentives is a win-win for both the pharmacy and wholesaler.”

The tool then takes the model’s computations and turns them into simple and actionable recommendations for the pharmacy. If the recommendations are implemented by the pharmacy, it will maximize rebates and profitability, arriving at the lowest total cost of inventory possible.

Accurate, lucrative recommendations

The pharmacy receives these recommendations in a daily Navigation report, which can be thought of as a GPS. Every day, the report provides step-by-step instructions to guide you to your end destination: maximum rebates and profitability.

The report shows you where you’re currently located with your purchasing for the month. Then, using the predictive modeling information, it guides you to the optimal NDCs and dollar volumes to purchase from your primary wholesaler.

“If you’re in the cockpit of a plane, you have heading, speed, and turn indicators as well as an altimeter, all of which are important to knowing where you’re at, whether you’re level, and whether you’re going where you need to go. That’s the first part of the Navigation report,” Balcom said. “But just like the pilot of an aircraft relies on air traffic control and guidance systems to see what the pilot cannot easily see, the Navigation report has a second part. And that is the action plan. The control tower says, ‘I need you to go to 31,000 feet and I need you to change your heading X degrees, here’s the adjustments you need to make.’ The Navigation report is the control tower coming back to you, as the pilot of your business, and giving you the timely and clear adjustments you need to make to stay on heading for where you need to get to in order to achieve maximum financial performance.”

For example, the report may guide you to swap your Actavis methylphenidate for SpecGx methylphenidate. And it may tell you to stop buying the methylphenidate from one supplier and start buying it from another. In one pharmacy’s model, that methylphenidate switch saved them nearly $300 from that single item change. “Now take that times fifty to a hundred purchases a day times thirty days a month,” Balcom said. And the report does this calculation for every item in your inventory. Every day.

“We recalculate every day based on the purchasing decisions a pharmacy has made throughout the month and up to and including the day before,” Balcom said. “We then adjust our guidance to recalibrate and make sure they remain on a peak performance trajectory.”

Many pharmacies have averaged a six-percent savings on their total volume with ProfitGuard and the Navigation tool. For the independent pharmacy whose cost of goods is $2,768,280—the annual average according to the NCPA Digest—that’s $166,096 straight into their pocket by the end of the year. Some have averaged even more.

“The Navigation report is short and to the point, allowing us to maximize our rebates by allocating purchases to the proper supplier,” said Dick Roberts, owner of Eureka Pharmacy in Eureka, Kansas. Before using the Navigation report, Roberts hadn’t been keeping up with his generic compliance and had been “making adjustments on the fly,” he said. “Now we are able to move purchases from Cardinal to PBA Health or from PBA Health to Cardinal to maximize our GCR on both accounts and maximize our rebates.”

If you’re already purchasing correctly, the report won’t make recommendations, just as a GPS won’t talk to you until it’s time to change direction. “We’re only correcting what’s not optimized,” Balcom explained.

And the good news for skeptical owners is that you’ll get a walkthrough of how exactly these savings occur, which means you don’t have to take PBA Health’s word for it.

Easy, simple, stress-free

The Navigation tool not only maximizes rebates and profitability, it also makes your purchasing easy. “What every pharmacy wants is to make the most money they can while expending the least amount of time and effort,” Balcom said. “The more pharmacies use the tool, the more money they make and the more resources they conserve.”

At RxShoppe, this time-saving benefit has been a sigh of relief for Butler and her team. “We were spending way too much time trying to find a better deal, working with too many companies to find the one that worked for one item,” Butler said. The Navigation report has simplified and streamlined her pharmacy’s ordering, freeing up valuable time for her and her employees. “It has definitely made it easier to order,” she said. “We do not have the manpower to devote someone to evaluating all the purchasing data to make the decisions. The Navigation tool narrows this all down for us—makes life easier. Saving time and money.”

The same goes for Roberts. “It’s very easy to use and it makes summaries of both accounts that I did not take the time to do,” he said. “It is very user friendly.”

And it does that while preserving the pharmacy’s autonomy and control. It’s entirely up to you to make the changes or ignore them. “We provide all the systems, analysis, and reporting, but the pharmacies still make the final decision as to what’s best for them,” Balcom said. “It’s the perfect mix between getting the benefit of that holistic analysis and guidance but with your degree of control that you want to have.”

Everything about the Navigation tool is designed to make life easier and more profitable for independent pharmacists and pharmacy owners. A membership company exclusively owned by the independent pharmacy owners it serves, PBA Health’s end goal is to help independent pharmacies better manage the buy-side of their business, so they achieve better profitability. And in turn, better care for their patients.

“Our mission is to help every pharmacy as much as we can and as much as each pharmacy will permit us to,” Balcom said. “With all the pain we see pharmacies facing on the payor-side of the business, it’s good to know we can bring them benefits that make their lives better and allow them to go home feeling successful on the buy-side of the business.”

Find out how much your pharmacy could save with ProfitGuard.

From the Magazine

This article was published in our quarterly print magazine, which covers relevant topics in greater depth featuring leading experts in the industry. Subscribe to receive the quarterly print issue in your mailbox. All registered independent pharmacies in the U.S. are eligible to receive a free subscription.

Read more articles from the March issue:

- These are the top front-end items to get on your pharmacy selves

- The essential guide to retail pharmacy layouts

- How to get five-star reviews online and why you can’t afford anything less

- This independent pharmacy owner is standing up to PBMs

- How to reap more revenue with your point-of-sale system

- How safe is your pharmacy from a robbery?

- Is technology the solution to non-adherence?

A Member-Owned Company Serving Independent Pharmacies

PBA Health is dedicated to helping independent pharmacies reach their full potential on the buy-side of their business. Founded and owned by pharmacists, PBA Health serves independent pharmacies with group purchasing services, wholesaler contract negotiations, proprietary purchasing tools, and more.

An HDA member, PBA Health operates its own NABP-accredited secondary wholesaler with more than 6,000 SKUs, including brands, generics, narcotics CII-CV, cold-storage products, and over-the-counter (OTC) products — offering the lowest prices in the secondary market.