In 2004, Amazon founder Jeff Bezos wrote a letter to shareholders explaining his business’s most important financial measure. What he didn’t say will surprise you. He did not mention profit. Nor did he cite earnings. Not even capital, EBITDA, or sales.

“Our ultimate financial measure, and the one we most want to drive over the long-term, is free cash flow,” he said. Above every other measure, cash is the engine that drove the small online bookstore to a $1 trillion global company.

Amazon is the most apparent example of what business experts and investors have known for a long time. “Cash flow is vital to the success of a business,” said Brent Rollins, RPh, PhD, Associate Professor of Pharmacy Practice at the Philadelphia College of Osteopathic Medicine Georgia Campus School of Pharmacy. “More often than not, when you look at the health of a business, the cash flow statement is just as important if not more important than anything else.”

Many business owners equate profitability with success, a common conception that fails to acknowledge that a company can be profitable and still fail. “This is where many companies get tripped up,” said Brian Cairns, founder of ProStrategix Consulting, a consulting firm that provides guidance and expertise to small businesses. “You can book profit while still having a negative cash balance.” If profits are tied up, say in reimbursements or inventory, then the company may not have enough cash to pay the bills when they’re due. You can’t pay salaries with IOUs or profit statements.

“Cash is like air and profit is like food,” Rollins said. “You can survive for a while without the food but if you don’t have air you can’t breathe. That’s why they say cash is king.”

What is cash flow?

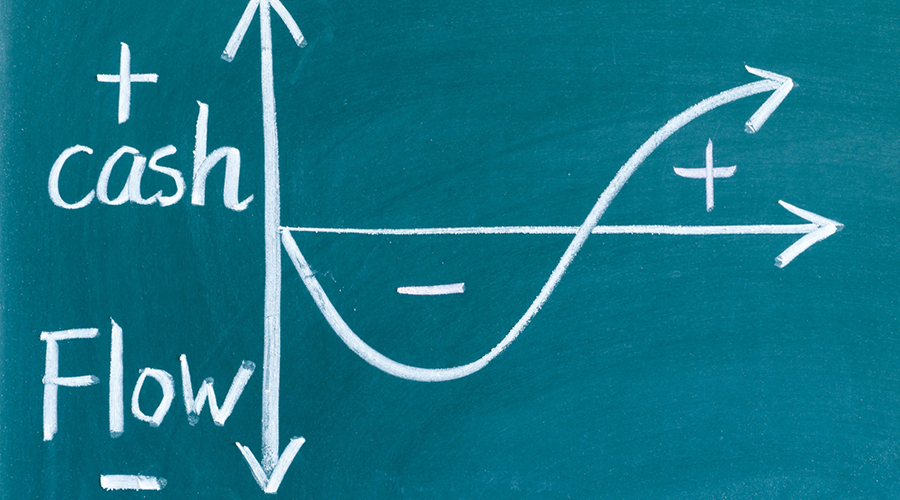

Cash flow is the journey from a sale at the register to cash in your bank (getting paid) to cash out of your bank (making payments). “You can think of it as how much money you have in the bank over time,” Cairns said. The better your cash flow, the more money you’ll have on hand to invest in your business, pay your bills, and prepare for unexpected expenses. In short, cash flow keeps your business sustainable.

Cash and profit won’t typically be an either/or question at your pharmacy. Ultimately, all profit eventually translates to cash. But sometimes you need to prioritize one over the other. The main difference between cash and profit is timing. Although all revenue becomes cash, it takes time to get there, and that difference introduces a tension that affects your business decisions in substantial ways.

If you need to speed up cash flow to make your payments on time, you may have to sacrifice profit. You may need to mark down items to sell them faster, or you might delay inventory payments and miss out on prompt pay discounts, for example. The sweet spot every pharmacy business owner needs to learn is how to maximize profits while maintaining a positive cash flow.

The bottom line

At the end of the day, improving your cash flow is about converting sales to cash in the bank in a timely manner—so you have cash when you need it. Many elements affect how long it takes to see money in your bank account after a patient pays for a prescription and how long it takes for money to leave the bank when you need to make a payment.

On the cash-received side, these factors include “rebates, reimbursement, merchant processing time, bank processing time, or anything which causes cash to be held in accounts receivable,” Cairns said. On the cash-spent side, there is payroll inventory replenishment, supplier terms, petty cash, expenses, interest payments, loan payments, rent/lease terms, or anything that affects accounts payable. “This is challenging since most of it is outside the pharmacy’s control,” he said. “It’s best to focus in on what you can control.”

To do that, you have to understand your financial statements. “Those matter as much as anything, probably second after understanding how to take care of patients and do your job,” Rollins said. “Knowing and understanding the things that impact your financial health through financial statements—what’s an asset, what’s a liability, what’s a balance sheet.”

Fully mastering the financials requires further knowledge of some basic formulas for calculating cash flow day-to-day and month-to-month for your pharmacy—such as how long it takes on average for your sales to convert to cash and when precisely each month you’ll need the cash available. That knowledge enables you to leverage decisions and ensure you’re receiving enough cash by the time you owe it. (Check out the sidebars in this article for the metrics you should know.)

Once you understand your financials, you’ll know how much cash you need to free up and when. Even small changes across the board can start churning out cash to sustain your pharmacy through tough times or through rapid growth.

Two Ratios to Know

Dr. Rollins makes sure his students master these two ratios in his classes. “In essence it’s a measure of how well you can pay your debts,” Rollins said. These can serve as a quick temperature gauge of your short-term cash flow, or at least your ability to turn your assets into cash.

Current Ratio

Current Ratio = Current Assets ÷ Current Liabilities

This metric reflects how many dollars of current assets the pharmacy has to pay for each dollar of current liabilities. This number should be more than two.

Quick Ratio (Acid Test)

Quick Ratio = [(Cash) + (Accounts Receivable)] ÷ Current Liabilities

This metric reflects how many times the pharmacy can immediately cover its current liabilities if it had to, without including inventory. This number should be more than one.

6 Methods to Increase Pharmacy Cash Flow

1. Establish a line of credit

A line of credit provides short-term, low-cost funds to meet the day-to-day expenses of your business when your cash flow isn’t sufficient. “It’s a fail-safe measure from which you can draw up to a pre-set amount at a fixed rate,” Cairns said. “You use it as you need, and pay it off over time. This is generally much better than factoring invoices or other less desirable sources of cash.”

Make sure to establish a line of credit with your bank before you actually need it. One of the biggest mistakes pharmacies make, Cairns said, is not seeking a line of credit when business is good. “Banks are most likely to lend when you are in great shape,” he explained. “If you wait until you have a problem, then you will be left with few good options.”

Rollins cautioned against seeking a line of credit to pay for depreciating assets, but he otherwise recommended the idea. “As long as the credit helps you survive a period of time while you’re getting started or into something that will add value to your business and help you grow, then you’re doing a positive thing.”

2. Collect receivables

As long as your receivables are sitting on the balance sheet, they’re not putting cash in your pocket. “Here’s the ultimate point: You have to get paid fast,” Rollins said. If you are waiting on a late check, but something is due right now and you don’t have the cash to cover it because you were expecting a payment that didn’t come, you’ll find yourself in trouble. “Getting paid fast and consistently is of the ultimate importance.”

Monitor your receivables on a weekly or monthly basis, paying attention to the number of days it takes before a receivable gets converted to cash. It should take less than 20 days on average for credit sales and insurance claims.

If you notice past-due receivables, contact the patient to verify his or her insurance information, then contact the insurance company to ensure the prescription was billed correctly.

You should also consistently reevaluate your payment terms from third parties and try to negotiate terms that accommodate your needs. “When you have to owe something to someone, try to negotiate the payment terms,” Cairns said. “You have to evaluate your terms and make sure it’s the best deal for you, based on your cashflow.”

Pharmacy Services Administration Organizations (PSAOs) may be able to help with both reconciliations and negotiations. Many of them offer reconciliation services that can speed up payments, and most provide increased leverage negotiating with third parties on payments terms.

3. Forgo prompt payment for supplies

As you know, wholesalers offer varying allowances on payment times but generally give up to 90 days. The longer you wait to pay, the more cash you’ll have on hand. If you have a high need for cash flow, waiting the full 90 days will help you keep cash longer.

However, this strategy can reduce your profit. Because most wholesalers offer financial incentive to pay quickly, you’ll likely be sacrificing profitable discounts by holding out. This is where it’s crucial to have a good grasp of your financials, so you can decide if the benefits of increased flow outweighs the benefits of increased profit. “That decision is learning—learning your own cash flow, what goes in, what goes out, when can you do those things, when does it work for you as a business owner to save that two percent,” Rollins said.

4. Choose POS vendor wisely

Cairns suggests shopping your point-of-sale vendor—they all convert sales to cash at different speeds. If cash flow is a consistent problem for your pharmacy, a quick conversion speed may trump other perks that a slower vendor offers. “It’s often not much, but worth shopping around,” he said.

5. Improve inventory management

Inventory control is Rollins’ top suggestion for cash flow improvement. “It’s such a large expense for a pharmacy,” he said.

Cairns agrees. “Inventory is locked-up cash,” he said. “You can’t pay your employees with inventory, so actively managing it is key to long-term cash flow stability.”

Pharmacies should be using technology and automation to manage inventory, such as a perpetual inventory system. Cairns recommends weekly or bi-weekly inventory reconciliation to remove products that are tying up your cash for too long. “This is where a good merchandising system is important,” he said. “If an item is sitting on your shelf for longer than the supplier’s terms, you probably shouldn’t carry it. Sometimes, it’s not possible to order just the right amount, but it also underscores why it is so important to know the impact that inventory is having on your cash flow.”

The most important thing you can do, Rollins said, is really get to know your patients. Instead of relying on general estimates, learn your patients’ particular buying habits. That will enable you to purchase the right amount of inventory at the right time, making sure you’re only using up as much cash as you absolutely need to.

6. Minimize payroll

Reducing payroll reduces the amount of cash going out of your business. That doesn’t mean getting skimpy with wages and salaries, but it does mean implementing an efficient work schedule that employs the right amount of staff at the right time. This goes back to Rollins’ emphasis on knowing your patients. Understanding the traffic patterns in your pharmacy enables you to more precisely schedule the minimum number of employees necessary to handle the workload as well as set the right hours and days you’re open for business.

7. Change your tax method

With some adjustments to your tax reporting, you can free up a significant amount of cash in a single year, thanks to the 2017 Tax Cuts and Jobs Act, according to Sykes and Co., PA, an accounting firm. In the past, most pharmacies have been required to report under the accrual basis of accounting, which means they report revenues and expenses when they’re earned, even if they have not received or paid cash yet. But because of the Tax Cuts and Jobs Act, pharmacies with revenues under $25 million can now switch to accounting on a cash basis, meaning they would only report revenues and expenses when the cash is received and paid. In most cases it wipes out a large part, if not all, of the income for the tax year for most pharmacies, Sykes said.

If pharmacies make the switch, they can also decide to deduct the inventory on their books, which could apply to hundreds of thousands of dollars for a single pharmacy. Under the new law, Sykes said, pharmacies can treat inventory as non-incidental materials and supplies, which can be expensed if the line item is less than $2,500. In other words, pharmacies can write off every single item of inventory invoiced under $2,500.

These Are the Most Important Pharmacy Metrics to Measure

These Are the Most Important Pharmacy Metrics to Measure

This white paper includes 30+ formulas to calculate the most important metrics for independent pharmacies. You’ll learn to think like a retailer, discover the methods to track and measure meaningful pharmacy metrics, and learn ways to use pharmacy metrics to get insight into business performance.

From the Magazine

This article was published in our quarterly print magazine, which covers relevant topics in greater depth featuring leading experts in the industry. Subscribe to receive the quarterly print issue in your mailbox. All registered independent pharmacies in the U.S. are eligible to receive a free subscription.

Read more articles from the September issue:

- Robotics quadrupled this pharmacy’s business

- Long-term care opens the door to long-term pharmacy profits

- How to find a premier secondary supplier

- Is it time for your pharmacy to downsize?

- Your pharmacy’s appearance matters more than you think

- How to protect patients and profits during shortages

A Member-Owned Company Serving Independent Pharmacies

PBA Health is dedicated to helping independent pharmacies reach their full potential on the buy-side of their business. Founded and owned by pharmacists, PBA Health serves independent pharmacies with group purchasing services, wholesaler contract negotiations, proprietary purchasing tools, and more.

An HDA member, PBA Health operates its own NABP-accredited secondary wholesaler with more than 6,000 SKUs, including brands, generics, narcotics CII-CV, cold-storage products, and over-the-counter (OTC) products — offering the lowest prices in the secondary market.

These Are the Most Important Pharmacy Metrics to Measure

These Are the Most Important Pharmacy Metrics to Measure