Everywhere you look, there’s a promotion prodding you to make a purchase. An email offering free delivery for one day only. A postcard promising 20 percent off any item. A receipt riddled with personalized coupons. As every major retailer seems to be playing the discounting game, should your retail pharmacy, too?

Discounting can benefit your business in a few significant ways, according to Kirk Jackisch, president of Pricing Solutions Ltd, a boutique consulting firm focused exclusively on the pricing space. Discounting can attract new customers, increase visits, and increase purchases per visit. At the end of the day, you may lose margin on some items, but overall, you make gains to your bottom line.

But discounting is a double-edged sword. If done poorly, Jackisch said, “you’re essentially just giving margin away.” Because it’s such a delicate endeavor, discounting requires planning, along with some analytics, which is why many businesses seek outside assistance with their pricing decisions. But for those who do pricing and promotions in-house, Jackisch has provided some best practices based on his 25 years of expertise.

Guiding principles

Before slashing prices or slinging coupons, pharmacies must always ask whether the discount will achieve one of three goals, Jackisch said. Will it bring in someone new? Will it bring in someone more frequently? Will it make someone spend more? These goals should drive the entire discounting strategy, whether it’s deciding the specific items to discount, the timing of the discount, or the type of discount.

After that, there’s still a key factor to consider. Suppose a discount seduced Sandra into buying a bottle of shampoo on her visit to pick up hair spray. That achieves one of your goals. You got a customer to increase her spend. But during the same promotion, nine other customers who normally buy the shampoo just got a nice price reduction without giving you anything. On the whole, is your pharmacy better off after that promotion?

“You might be successful at bringing new customers in, but you’re actually behind in terms of the money that you take home at the end of the day,” said Jackisch. That’s because you have to make up in volume what you give away in margin. “If it’s fifty percent margin, for example, and you’re taking a five or ten percent discount, you need to make up ten or twenty percent increase in volume just to get the same dollars in profit.”

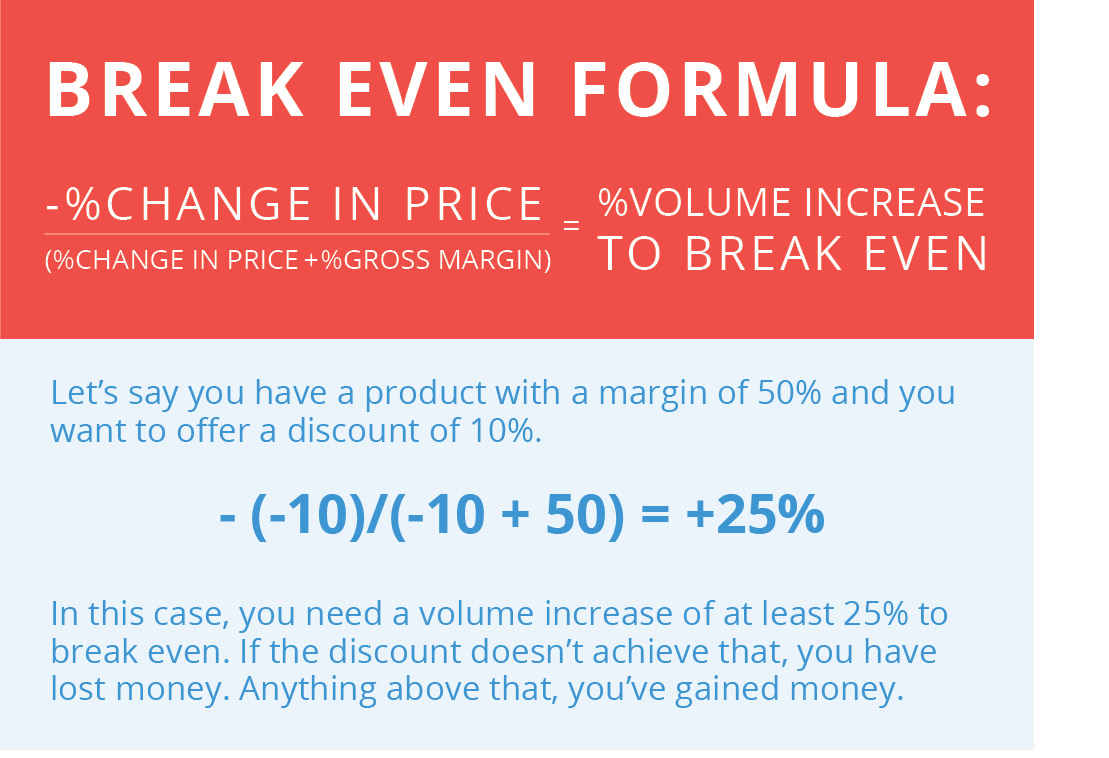

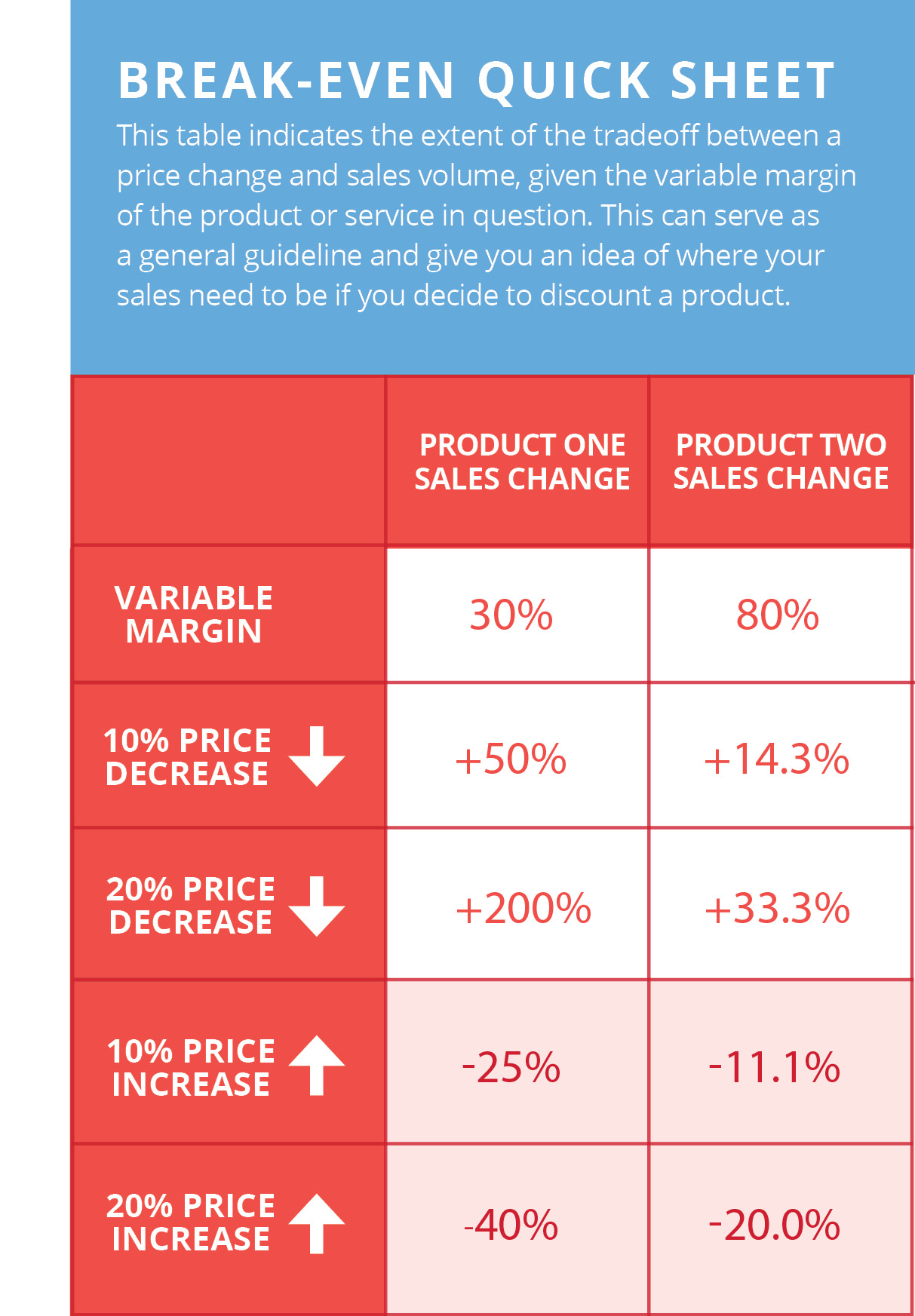

This is how to start thinking with the “logic of a pricer,” Jackisch said. A good pricer always evaluates whether the business will be better off economically after a discount, which means the volume gain outweighs the margin loss. Figuring that out requires a calculation called the break-even point, which determines the volume increase you need from the promotion to get back to even financially. At break-even, it’s a wash. Above that, it’s a win. As a general rule, the higher the margin, the less volume you need. The lower margin, the more volume you need.

Potential pitfalls

Sticking to your goals and break-even points will safeguard you against most discounting pitfalls, but there are still some common mistakes to watch out for.

The worst is discounting a product that people are already going to buy. “That is the cardinal sin and it is probably the one that befalls most pricers most frequently,” Jackisch said. “You’re basically just giving margin away and not getting any benefit. I will tell you anecdotally that more discount programs fail because of this than succeed.”

To avoid this, you need to determine the impact of a discount on your existing base. Ideally, you’ll keep frequent purchases at full price and instead focus on less popular items that still have high demand in the market. “That would be the nirvana,” Jackisch said. “The trap is that people will say, ‘Everybody is buying this so there must be more out there, so I’m going to discount it,’ and at best you’re maybe slightly ahead and more likely neutral or actually behind.”

Another way to avoid this mistake is to refrain from discounting items that are typically recurring purchases, like daily vitamins or lancet test strips. Customers will simply buy next month’s or week’s amount at the discounted rate and avoid having to return to the store at a later time. Customers are simply buying ahead, with no gain to the seller.

The other major discounting mistake is sitting on your haunches, so to speak, which Jackisch said is a common problem he sees in many businesses, especially ones without significant resources to invest in pricing. “There’s a certain level of inertia that comes with pricing and promotions,” he said. Owners often default to last year’s calendar, running the same discounts without much scrutiny. Jackisch recommends revisiting your promotion calendar annually and adjusting your strategy based on the success of the previous year’s promotions and your business strategy this year.

“This is not something you can do casually,” he said. “You have to recognize that without significant investment in pricing capabilities, it’s trial and error. You have to make sure you’re adjusting it accordingly to make sure it’s successful.”

That means digging into your data to measure how each promotion fared. Did your 20-percent-off promotion cause a spike in purchases or new customers? If so, how much? You can evaluate the total volume increase by surveying your point-of-sale records for how many transactions occurred during the promotion relative to a period without the promotion. That will give you the data you need to calculate your break-even point. To find out how many new customers you gained, you can use your loyalty program data. Even if your data isn’t robust, Jackisch said, “It still gives you directional information instead of that inertia of repeating last year’s promotional calendar.”

7 Trade Secrets for Successful Discounts

Kirk Jackisch, president of Pricing Solutions, a consulting firm focused exclusively on the pricing space, offers seven tried-and-true discounting tips he’s learned over his 25 years in the pricing industry.

1. In and outs

In and outs are items with a temporary shelf duration, typically seasonal or holiday products that come and go quickly. Think egg baskets and hand warmers. Christmas cards and back-to-school supplies. These items increase the spend of existing customers, bring in new customers, or bring in current customers more frequently. You can keep your full margins on the rest of your front end because these items will do the promotional legwork. Consider making the discount contingent on a separate purchase, such as buy one item get another half off.

2. Bundling

Bundling more than one item into a deal allows you to increase spend by selling an extra item the customer wouldn’t otherwise have purchased. Put items together that have high associations, and make at least one of them a high-margin product. Buy a beverage and get 20 percent off a chocolate bar, for example. Target items with high price sensitivity because those are likely to get you enough volume to offset the discount.

3. Fallow times

Have you noticed movie theaters offering BOGO tickets on Tuesdays? The purpose is to get people to show up on those nights when the theaters normally sit empty. A discount carries no loss risk because the theater isn’t earning business anyway. Are there times of the day, week, month, or year where you suffer a drought of traffic or have drops in demand for specific categories? Consider saving your promotions for those fallow periods to get people flowing through your aisles.

4. Loyalty program

Offering exclusive discounts to customers in your loyalty program encourages people to sign up for the program. You get valuable data that in the end helps you bring those customers in more frequently or increase their basket size when they visit in the store. When you can see all of their purchases, including when they are making them, you can better structure your promotions around that person to more effectively persuade them to spend more or visit more frequently.

5. Price point endings and thresholds

There are price thresholds that consumers are sensitive to. The most common one is the 99-cent threshold. In some spaces, an increase from $9.99 to $10.01 results in a 15 percent reduction in demand. People see ten dollars versus nine dollars. Then there are price point endings. For example, there’s no impact on demand from $0.93 to $0.99. Utilizing some of those key thresholds, especially for products people purchase a lot of and the price is well known, will drive profits. For example, if you have a product that’s at $5.39 and you get it down to $4.99, you’re going to have a much bigger kick than if you take it down to $5.09. And taking it down to $4.79 isn’t going to get you any more positive impact than $4.99.

6. Addition over subtraction

Adding value is always preferable to providing a cash discount. A customer is indifferent to getting two dollars off versus getting something worth two dollars more. But for you, it makes a difference. The cost of the two-dollar discount is two dollars, while the cost of the two-dollar add is likely a dollar—or for a high-margin product, 50 cents. So instead of giving away two dollars, you give away 50 cents and the value to the customer is the same.

7. Value-based pricing

Value-based pricing takes into account your pharmacy’s total value proposition to the customer, which includes a host of factors that make up a customer’s experience of your pharmacy: location, parking, product selection, customer service, checkout experience, layout, and so on. To truly know what promotions will make you better off economically, you have to price relative to your value proposition. The more value you offer, compared to your competitors, the less your prices matter. The less value you offer, the more they matter.

From the Magazine

This article was published in our quarterly print magazine, which covers relevant topics in greater depth featuring leading experts in the industry. Subscribe to receive the quarterly print issue in your mailbox. All registered independent pharmacies in the U.S. are eligible to receive a free subscription.

Read more articles from the June issue:

- The top challenges (and solutions) of operating multiple pharmacies

- The impact of the coronavirus on the future of retail pharmacy

- Effective strategies to minimize financial losses from PBM audits

- How to put together an effective discount strategy for your front end

- Is diabetes care a good business opportunity for pharmacy?

- This technology reduces the will call process from minutes to seconds

- What kind of insurance coverage does your pharmacy need?

- How two pharmacies improve operations with their pharmacy management systems

An Independently Owned Organization Serving Independent Pharmacies

PBA Health is dedicated to helping independent pharmacies reach their full potential on the buy side of their business. The company is a member-owned organization that serves independent pharmacies with group purchasing services, expert contract negotiations, proprietary purchasing tools, distribution services, and more.

An HDA member, PBA Health operates its own NABP-accredited (formerly VAWD) warehouse with more than 6,000 SKUs, including brands, generics, narcotics CII-CV, cold-storage products, and over-the-counter (OTC) products.

Want more pharmacy business tips and advice? Sign up for our e-newsletter.